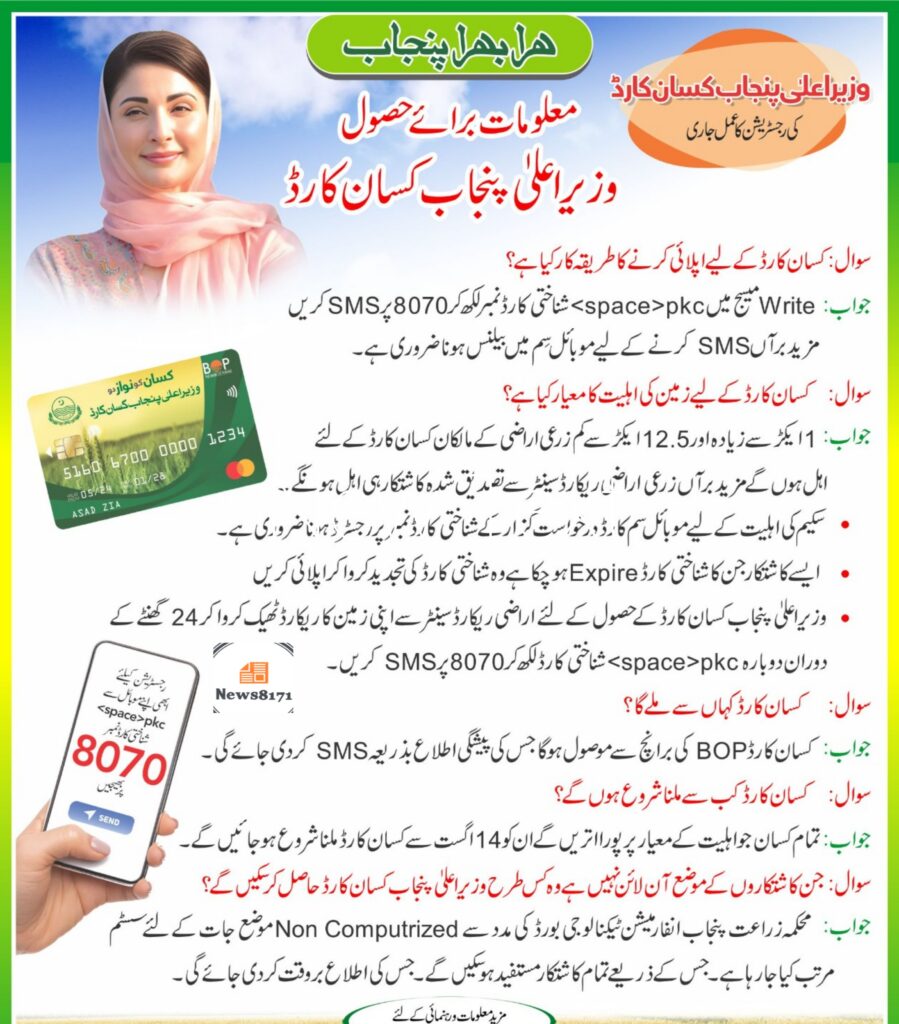

Farmers for Punjab Kisan Card

The Kisan Card will be given to farmers by the Bank of Punjab.1 million applications have been received for the Kisan Card. Farmers who meet the qualifying conditions will be given a Kisan Card by the Bank of Punjab very soon. Farmers will get many perks through the Kisan Card. By Kisan Card, they will be able to get a loan of Rs 30,000 per acre for fertilizer, seed, pesticide, etc. for their crops.

Farmers will be able to make easy payments for it.

After getting the Kisan Card, farmers will be able to join in the Green Tractor Scheme, Agriculture Programme, and all other programs started. Farmers who haven’t registered yet should do so right away by sending their ID card to 8800. This will register them and send them an SMS letting them know they can pick up their Kisan Card at Punjab Of Bank. Follow this tale to learn all there is to know.

Farmers for Punjab Kisan Card Eligibility Criteria

- Farmers who apply must be at least 18 years of age.

- The farmer must be a native of Pakistan.

- The farmer must be the owner of the farming land or the land is offered for rent.

- The farmer must be registered in the relevant government papers.

- Farmer’s CNIC (Computerized National Identity Card) and proof of land ownership must be given.

- Farmers for Punjab Kisan Card Required Documents

- A copy of your national identity document.

- records that prove your ownership of farming land such as land rent deal records.

- Recent Passport-Sized Photographs

- A document showing you are registered as a farmer with the relevant government body.

Registration Process for the Kisan Card

Kisan card registration is very easy, you can simply register online or through SMS. The complete process for registration is as follows.

Aslo Read…Breaking News! Farmers for Punjab Kisan Card Full Details ||

| Category | Details |

|---|---|

| Program Objective | Provide financial assistance to farmers through loans for agricultural inputs. |

| Loan Amount | Up to PKR 150,000 per crop cycle for seeds, fertilizers, and pesticides. |

| Eligibility | – Farmers with up to 12.5 acres of registered land. – SIM registered under the farmer’s CNIC. – Verified by NADRA with no loan defaults. |

| How to Apply | 1. Send SMS: “PKC [CNIC]” to 8070. 2. Create a mobile wallet for transactions. 3. Visit Tehsil Office: Submit required documents and fill out the form. |

| Loan Repayment | Loans are interest-free and repayable within 6 months. After repayment, farmers can apply for new loans in the next crop cycle. |

| Kisan Card Collection | Farmers are notified once the card is ready and can collect it from the Tehsil Office. |

| Number of Beneficiaries | Targeted to benefit 500,000 farmers in Punjab. |

| Key Benefits | – Easy access to production loans. – Interest-free installments. – Promotes agricultural productivity. |

| Official Website | Visit the DPMIS Punjab or local Tehsil Offices for more details. |

First, you check your status to see if you meet the qualifying conditions.

Prepare the following documents: CNIC (Computerized National Identity Card) Land holding proof Passport size photos.

More Read..Trending News: Check Eligibility Online For Himmat Card

- Visit the official Kisan Card page or the relevant government site.

- Fill out the application form with your right information.

- Upload the needed papers.

- After that, your application will be checked by the government officials.

- If your application is accepted, collect your Kisan Card from the local location or receive it by post.

Conclusion

Kisan Card is a great chance for farmers who want to improve their production at minimal cost so don’t ignore this possibility. Only 1 day left to join. Complete the online application or register by sending your CNIC to 8800, and if you are qualified, you will get your Kisan Card from the Bank of Punjab. This is your chance to get interest-free loans and other important perks that can add up significantly. Your efficiency. Apply now before it’s too late!

1 thought on “Breaking News! Farmers for Punjab Kisan Card Full Details || Apply must be at least 18 years of age”